Afterpay: Your Guide to Buy Now, Pay Later

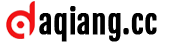

Afterpay is a user-friendly financial technology app that lets you purchase items and pay them off in installments. This convenient payment solution works for online and in-store shopping, offering interest-free payment options. Afterpay partners with numerous retailers, providing access to a vast selection of goods and services. Its streamlined checkout process transforms the shopping experience.

Key Features of the Afterpay App:

- Exclusive App Deals: Enjoy special offers and discounts available only through the Afterpay app, unlocking access to a wider range of brands and products.

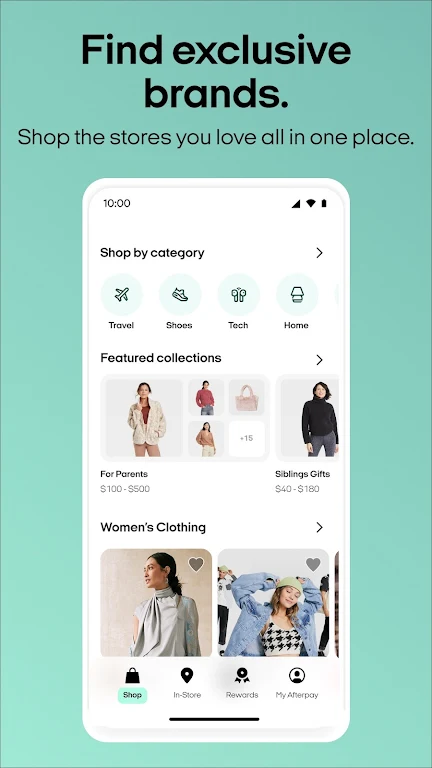

- Interest-Free Installments: Divide your purchases into four interest-free payments, simplifying budget management.

- Extended Payment Plans: For larger purchases, choose the flexibility of 6 or 12-month payment plans (at participating retailers).

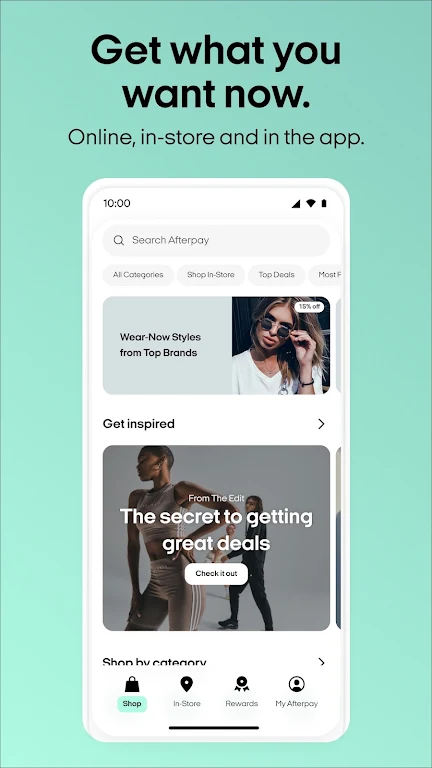

- App-Exclusive Brands: Discover unique brands and items only found within the Afterpay app.

Frequently Asked Questions:

Can I use Afterpay in stores?

Yes, many retailers accept Afterpay for in-store purchases.

How do I manage my payments?

The app allows you to easily modify payment schedules, pause payments for returns, and review your order history.

How can I get sale alerts?

Enable push notifications to receive updates on sales and price drops for your favorite brands and saved items.

More About Afterpay:

App-Exclusive Shopping: The Afterpay app provides a unique shopping experience, featuring numerous brand deals and the ability to split purchases into four interest-free payments, both online and in-store. Browse various categories including fashion, beauty, home goods, electronics, and more.

Flexible Payment Choices: Benefit from the added flexibility of 6 or 12-month payment options (where available) for larger purchases, offering better financial control.

Exclusive Brands and Curated Content: Discover exclusive brands and product categories, along with daily curated shopping guides and inspirational content to stay on top of trends.

Effortless Order Management: Easily track current and past orders, manage payments, adjust payment schedules, and pause payments for returns. Link your Cash App account for integrated order management.

Stay Updated on Deals: Never miss a sale or price drop with push notifications. Save items to receive alerts when prices fall.

In-Store Convenience: Use your virtual wallet to add your Afterpay card for seamless in-store purchases, with pre-approved spending limits to aid budgeting.

Improved Spending Limits: Consistent on-time payments can increase your spending limit.

24/7 App-Based Support: Access 24/7 customer support through the app's chat feature, FAQs, and assistance resources.

Important Information:

-

Terms and Conditions: Using the Afterpay app requires acceptance of the Terms of Use and Privacy Policy. Eligibility requires being 18 or older, a U.S. resident, and meeting additional criteria. In-store use may require further verification. Late fees may apply. See the installment agreement for complete details. California residents: Loans are made or arranged under a California Finance Lenders Law license.

-

Pay Monthly Program: Loans for the Pay Monthly program are provided by First Electronic Bank, Member FDIC. A down payment may be required. APRs vary (6.99% to 35.99%) based on eligibility and merchant. Credit checks and approval are necessary, and availability varies by state. A valid debit card, accessible credit report, and acceptance of terms are required. Estimated payment amounts shown exclude taxes and shipping. Full terms are available on the Afterpay website.